PayPal makes strategic move to boost stablecoin adoption by offering competitive yield on PYUSD holdings.

PayPal’s Yield-Bearing Stablecoin Initiative

PayPal is set to introduce a 3.7% annual yield on balances held in its PayPal USD (PYUSD) stablecoin, according to an April 23 Bloomberg report. This strategic move aims to incentivize broader adoption of the company’s dollar-pegged digital currency.

The yield program, scheduled to launch this summer, will distribute rewards monthly in PYUSD. Users can freely exchange these earnings for fiat currency, spend them, or transfer them to other PayPal users. Rewards will accrue daily and compound monthly, creating a compelling value proposition for holders.

Market Context and Regulatory Considerations

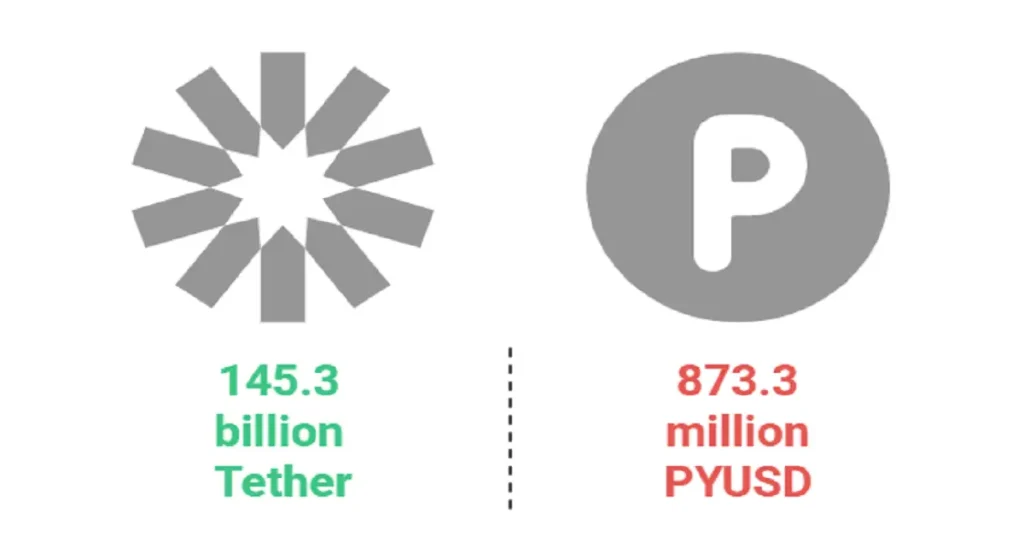

This development follows PYUSD reaching the $1 billion market capitalization milestone in summer 2024, though its current valuation stands at approximately $873.3 million at time of reporting.

Tzahi Kanza, CEO of crypto investment firm Syndika, highlighted the regulatory implications of yield-bearing stablecoins: “Stablecoins that don’t offer yield are generally not considered securities. However, yield-bearing stablecoins may fall under that classification.” He noted that while PayPal can likely fulfill its yield promises, the primary user risk remains potential depegging from the dollar rather than yield-related issues.

PayPal’s Expanding Crypto Strategy

This initiative represents PayPal’s latest move in its blockchain-focused expansion. Recent reports indicate the payments giant has broadened its crypto offerings to include Chainlink (LINK) and Solana (SOL), enabling US customers to buy, sell, and transfer these assets.

Polygon Labs CEO Marc Boiron identified PayPal as a key driver in stablecoin adoption: “Companies like Stripe and PayPal integrating stablecoins is likely the primary catalyst for their growth.”

PYUSD Background and Market Position

Launched in August 2023 through a partnership with Paxos Trust Company, PYUSD made history as the first stablecoin issued by a major payment network. Venmo added support for the stablecoin the following month.

Each PYUSD token is backed 1:1 by a combination of cash deposits, short-term US Treasury notes, and cash-equivalent assets regulated by the New York State Department of Financial Services. Originally an ERC-20 token on Ethereum, PYUSD has since expanded to the Solana blockchain.

Despite these developments, PYUSD’s market capitalization remains dwarfed by industry leader Tether (USDT), which boasts a $145.3 billion valuation – approximately 17,255% larger than PYUSD’s current market cap.

Kanza observed: “Tether’s strength lies in its market dominance — not in its regulatory compliance, transparency, or yield.” He suggested that PayPal could effectively compete by focusing on these three differentiating factors.